Track and Manage Income and Expenses with Aidango

Keep your cash flow under control with the association accounting program.

Linking Donations to Income Items

Manage your income sources by linking your donation groups and categories to income items.

Linking Dues Records to Income and Expense Items

Keep track of your entry and exit transactions by linking your membership fees to your income items and your recurring expenses to your expense items.

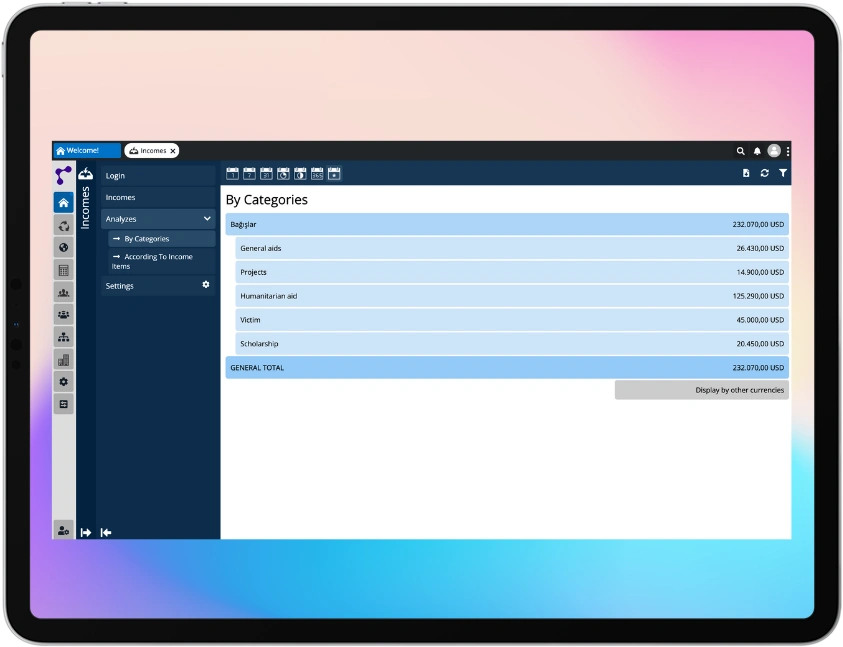

Income - Expense Tracking

List all your incomes on a single screen based on date with the association accounting program, save as Excel. Classify your expenses by defining cost centers, categories and expense items. See your total income and expenses.

Powerful Finance-Accounting Management Features with Aidango

Make the Process Efficient by Optimizing All Your Transactions

Cash and Bank Tracking

Define your cash and bank accounts across different branches. List all money movements by time periods.

Cash Flow Management

Track all your daily financial transactions such as income, expenses, expenses, advances with a single association accounting program. Also list your payments, invoices and proformas.

Budget Planning

Compare your targeted and actual income and expense items by planning your budget. This allows you to observe the differences between them and their realization rates.

Advance Tracking

Manage premiums and advances for a person or company by selecting them from your current accounts.

Cost Management

Create expense forms such as domestic and international travel, food, transportation. Define approval steps such as superior, financial affairs and general manager in these forms with the association accounting program.

Check and Promissory Note Tracking

List the check and bill transactions received or issued. View the status and due dates of these transactions.

Asset Management

Separate fixed assets by branch. Save them to different branches, debit personnel, and establish associations between different assets.

Payables and Receivables

Track payment types and terms by determining payable and receivable categories via the association accounting program. View your specific term and non-term payables and receivables for your customers. In this way, manage your financial transactions better.

Manage Your Association Accounting Management Operations Under One Roof

Manage all your transactions from one place, without needing additional software or platforms beyond those used for donations.

Create Your Income and Expense Items

Make your management more efficient by organizing your income and expenses into groups and categories.

Link Your Income and Expense Items

Quickly create your records by matching income and expense items with donations and expenditures.

Separate Your Dues as Income and Expense

Keep regular income and expense tracking by defining expenses subject to regular payments and recurring income.

- How can I manage income and expense tracking with Aidango?

Aidango allows you to easily track your income and expenses by date by categorizing them. It also provides more detailed financial tracking by defining cost centers.

- How to plan your budget in Aidango?

Aidango allows you to plan your budget by comparing targeted and actual income-expense items. This feature helps you detect budget deviations.

- How does Aidango's accounts receivable tracking work?

Aidango allows you to track your payables and receivables according to payment types and maturities, so you can easily manage your financial processes.